Knowing what factors change your credit score is important and can help you work on improving your credit score. Before learning about these influencing factors, it would be good to know what a credit score truly is.

A credit score is simply a number, usually ranging from 300 to 850. This number can relay important information to lenders, which helps them decide how much to lend you. The score is calculated based on your credit reports, payment histories, your debt, and the length of your payment history. Generally, the higher the number, the more chances you have of qualifying for loans.

The credit score is just one among the many factors which help the lenders assess how likely or capable you are to pay back the loan amount. Higher scores point out that you have displayed responsible credit performance in the past and it makes the loan officers more comfortable in giving out loans to you.

If one learns what factors affect the credit score, they can keep it from falling to unacceptably low numbers. In this article, we will talk about 5 factors influencing your FICO score (the credit score used by most lenders).

Below are the top 5 factors influencing your FICO.

1) Payment History: This is the most important aspect of your credit score. It accounts for 35% of your FICO score. Lenders want to know your history of loan repayments, the number of loans have you taken, the number of loans you have returned, late payments, and the frequency of your loans. Lenders want to be certain that you repay your debt on time and are a reliable person.

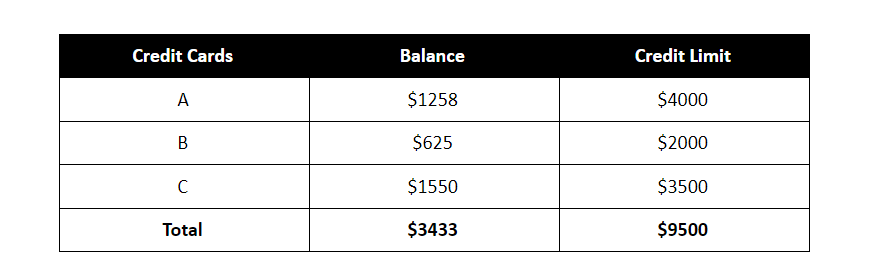

2) Amounts Owed: This can be referred to as credit utilization and is represented as a credit utilization ratio. This ratio is calculated by adding all the balances, and then all the credit limits. Divide the total balance by the total credit limit and then multiply the result by 100. The result is your overall credit utilization ratio.

To calculate total credit utilization, divide the balance of $3433 by the credit limit of $9500, to get .36 (after rounding). Then, multiply it by 100 to get 36%.

This ratio tells the lenders how reliant you are on non-cash funds and how much of your available credit you are utilizing. A ratio of 30% and above is generally not liked by lenders. Also, this particular factor accounts for 30% of your FICO scores.

3) Credit History Length: This refers to how long it has been since you have started taking loans. This includes the age of your oldest and newest credit accounts and an average age of all your accounts. As a rule of thumb, the longer the history, the better your FICO score. This also accounts for 15% of your FICO score.

4) Credit Mix: This refers to the portfolio of credit accounts you have had. The portfolio could have student loan accounts, mortgage loan accounts, and even car loans. Again, the more diverse your portfolio, the better it reflects on your FICO score. This tells the lenders how well you manage a diverse range of credit products. This accounts for 10% of your FICO score.

5) New Credit: This refers to the recent new loans you have taken and also the ‘inquiries’ or requests that have been made by lenders to look at your account to determine risk. This accounts for 10% of your FICO score. In this case, more is not merrier, meaning that more inquiries or more new loans do not reflect well on lenders.

Some Tips on How to Improve Your Credit Score

As could be reasonably inferred from the above discussion, there are ways or techniques by which you may maintain and improve your FICO score.

- Make sure you pay off any pending debts before you go out to take a new loan and pay off all outstanding charges against you to avoid your credit score taking a hit.

- It is also advisable that you try and maintain a good credit mix (if your budget allows).

- Be sure not to take out frequent new loans or new credits.

- Also, try to maintain a healthy credit utilization ratio by not over-using the credit allotted to you.

- Another useful tip is to dispute inaccurate information on your credit file, notice anomalies, and inaccuracies frequently. Report them and get them corrected as soon as possible.

Being intelligent about this matter can help you get in a better financial position with regards to your ability to get loan deals of your choice.